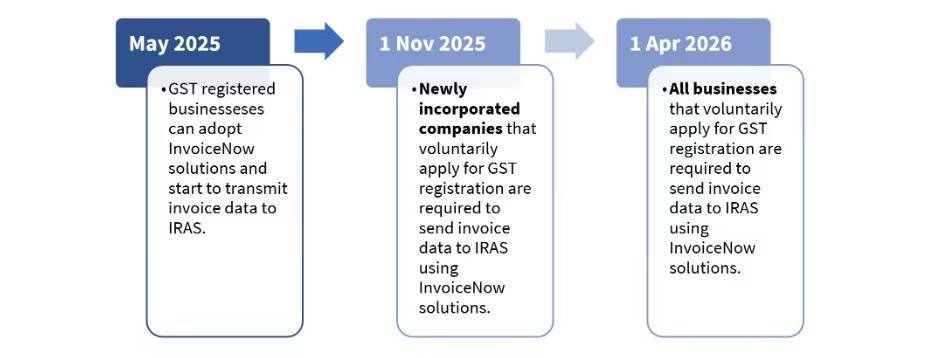

The latest requirements from the tax authority regarding implementation of InvoiceNow for GST register entities are as follows:

GST-registered businesses will be required to use the InvoiceNow solution to transmit invoice data to IRAS (Inland Revenue Authority of Singapore).

Starting from November 1, 2025, this requirement applies to newly incorporated companies that voluntarily register for GST (within 6 months of submitting their Goods and Services Tax registration application).

From April 1, 2026, this requirement extends to all new voluntary GST registrants, regardless of their date of incorporation.

Source: IRAS

A soft launch for early adoption will commence on May 1, 2025, allowing all existing GST-registered businesses to voluntarily transmit invoice data to IRAS using the InvoiceNow solution.

To assist businesses with the adoption and usage costs of InvoiceNow, IMDA (Infocomm Media Development Authority) has introduced various grants, such as the LEAD Connect & Transact Grant and the InvoiceNow Transaction Bonus. InvoiceNow solutions are also eligible for co-funding under the Productivity Solutions Grant.

GST-registered entities have always been a focus of attention. While Singapore has traditionally used paper-based invoices, it does not mean compliance can be taken lightly. For clients using InvoiceNow, there may be a reduced likelihood of being selected for GST audits. Those selected for audits may also expect shorter audit times and faster resolution of audit issues. Additionally, businesses with low assessed risks may receive GST refunds sooner if they request Goods and Services Tax refunds.

Businesses falling under the following categories will be exempt from the GST InvoiceNow requirement:

- Foreign Entities:This includes overseas vendors registered under the Overseas Vendor Registration system who do not have a physical presence or operations in Singapore.

- Businesses Registered under the Reverse Charge Regime:Companies registered under the Reverse Charge regime, where the responsibility for accounting for GST is shifted from the supplier to the recipient of the goods or services, are exempt from the GST InvoiceNow requirement.

These exemptions are important to note as they help delineate the scope of businesses required to comply with the GST InvoiceNow mandate in Singapore.