Increasing the CPF Ordinary Wage ceiling is a notable move to ensure that the CPF contributions align with the prevailing wage levels, thereby aiding in retirement savings.

This adjustment should benefit both employees and employers, as it reflects the evolving economic landscape and helps individuals secure their financial future.

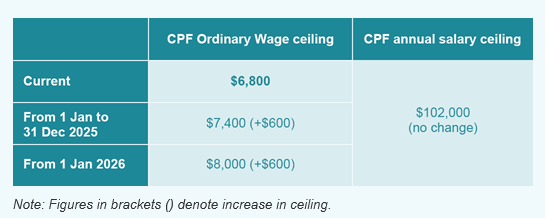

Increase in the CPF Ordinary Wage ceiling

To keep up with rising wages, the CPF Ordinary Wage ceiling (OW) for all employees will be raised to $7,400 in 2025 and will reach $8,000 by 2026.

(Source: CPF)

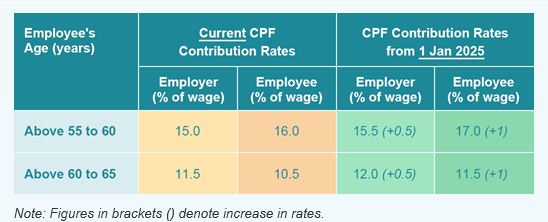

Increase in CPF contribution rates for senior workers

To continue strengthening retirement adequacy of senior workers, the CPF contribution rates for senior workers aged above 55 to 65 will be increased from 1 January 2025.

For employees earning monthly wages > $750

(Source: CPF)

The revised CPF contribution rates and OW ceiling will be automatically applied. However, if the submission of CPF contributions through other submission modes (i.e. CPF EZPay Mobile and CPF EZPay File Transfer Protocol), the CPF contributions need to be computed based on the revised rates and ceiling.